Accordingly, the per-unit cost of manufacturing a single packet of bread consisting of 10 pieces each would be as follows. In financial planning, the contribution margin provides a basis for forecasting and budgeting, enabling a realistic assessment of a company’s financial performance. However, relying solely on the contribution margin may not provide a complete picture of financial health. Instead, it should be used as part of a comprehensive financial analysis. Similarly, in baccarat, strategic planning can improve success. Winning more with baccarat tips includes consistently betting on the Banker for the best odds, managing your bankroll wisely, avoiding the Tie bet due to its high house edge, and following betting systems like the Martingale with caution. By applying these tactics, players can increase their chances of profitability and enhance their overall gaming experience.

Contribution Margin Per Unit

It means there’s more money for covering fixed costs and contributing to profit. A business can increase its Contribution Margin Ratio by reducing the cost of goods sold, increasing the selling price of products, or finding ways to reduce fixed costs. A high Contribution Margin Ratio indicates that each sale produces more profit than it did before and that the business will have an easier time making up fixed costs. A low Contribution Margin Ratio, on the other hand, suggests that there may be difficulty in covering fixed costs and making profits due to lower margins on individual sales.

Operating Profit or Loss

Thus, \(20\%\) of each sales dollar represents the variable cost of the item and \(80\%\) of the sales dollar is margin. Just as each product or service has its own contribution margin on a per unit basis, each has a unique contribution margin ratio. The Contribution Margin Ratio is a measure of profitability that indicates how much each sales dollar contributes to covering fixed costs and producing profits. It is calculated by dividing the contribution margin per unit by the selling price per unit.

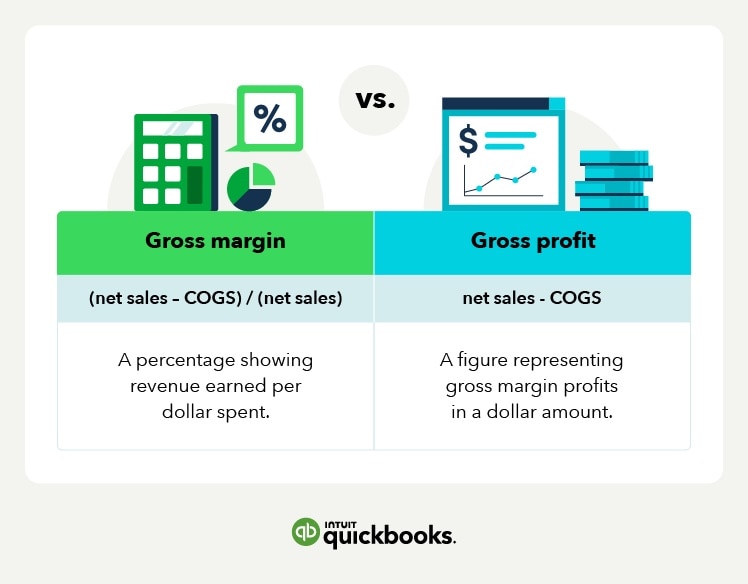

Contribution margin vs. gross margin

Let’s examine how all three approaches convey the same financial performance, although represented somewhat differently. Contribution margin ratio is a calculation of how much revenue your business generates from selling its products or services, once the variable costs involved in producing and delivering them are paid. This can be a valuable tool for understanding how to price your products to ensure your business can pay its fixed costs, such as salaries and office rent, and still generate a profit. The contribution margin is different from the gross profit margin, the difference between sales revenue and the cost of goods sold. While contribution margins only count the variable costs, the gross profit margin includes all of the costs that a company incurs in order to make sales. You might wonder why a company would trade variable costs for fixed costs.

Contribution Margin Ratio: Definition, Formula, and Example

Typical variable costs include direct material costs, production labor costs, shipping supplies, and sales commissions. Fixed costs include periodic fixed expenses for facilities rent, equipment leases, insurance, utilities, general & administrative (G&A) expenses, research & development (R&D), and depreciation of equipment. Calculating contribution margin (the difference between sales revenue and variable costs) is an effective financial analysis tool for making strategic business decisions. You need to calculate the contribution margin to understand whether your business can cover its fixed cost. Also, it is important to calculate the contribution margin to know the price at which you need to sell your goods and services to earn profits.

- Yes, the contribution margin will be equal to or higher than the gross margin because the gross margin includes fixed overhead costs.

- As another step, you can compute the cash breakeven point using cash-based variable costs and fixed costs.

- The contribution margin represents the revenue that a company gains by selling each additional unit of a product or good.

Understanding AI in Finance and Its Impact on Businesses

The concept of contribution margin is applicable at various levels of manufacturing, business segments, and products. Where C is the contribution margin, R is the total revenue, and V represents variable costs. The contribution margin can be stated on a gross or per-unit basis.

You may need to use the contribution margin formula for your company’s net income statements, net sales or net profit sheets, gross margin, cash flow, and other financial statements or financial ratios. The difference between the selling price and variable cost is a contribution, which may also be known as gross margin. Management uses the contribution margin shareholder equity se definition in several different forms to production and pricing decisions within the business. This concept is especially helpful to management in calculating the breakeven point for a department or a product line. Management uses this metric to understand what price they are able to charge for a product without losing money as production increases and scale continues.

Barbara is a financial writer for Tipalti and other successful B2B businesses, including SaaS and financial companies. She is a former CFO for fast-growing tech companies with Deloitte audit experience. Barbara has an MBA from The University of Texas and an active CPA license.