This tells us that not only is NPV the preferred choice from a theoretical perspective, it is also the preferred choice of firms in practice. However, equally important is the concept that many firms rely on multiple techniques rather than merely choosing one when evaluating capital budgeting decisions. Even though there are flaws with IRR and PP (which have been discussed above), they are still used in practice. Like the internal rate of return method, the net present value method considers the time value of money.

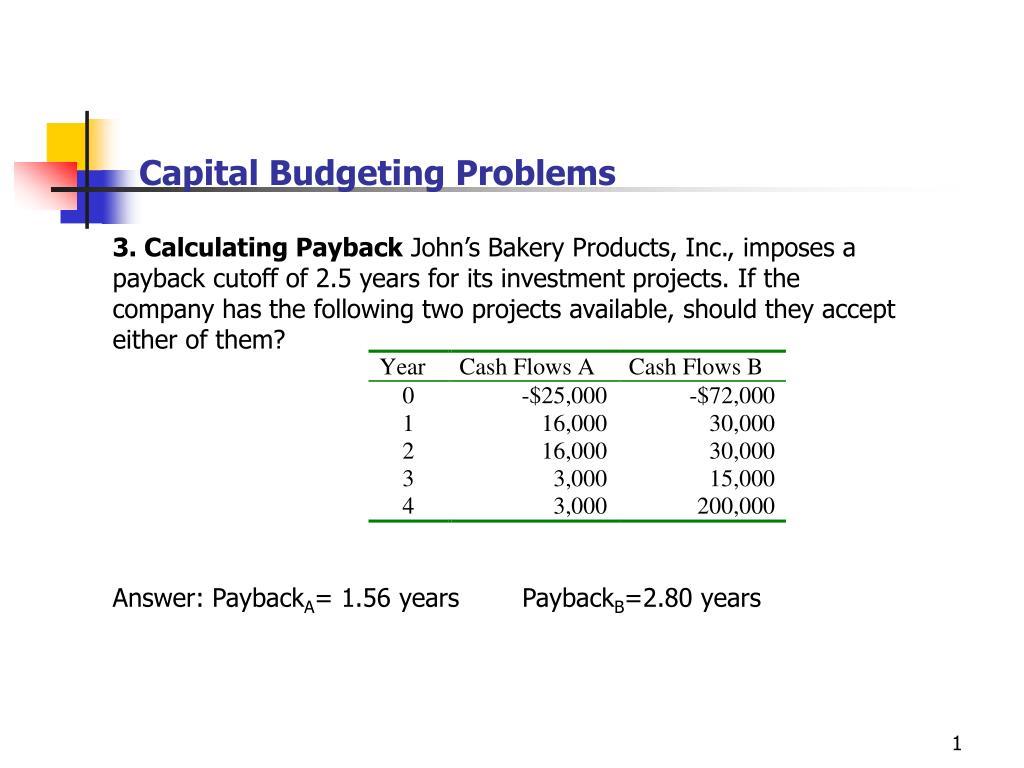

Payback Analysis

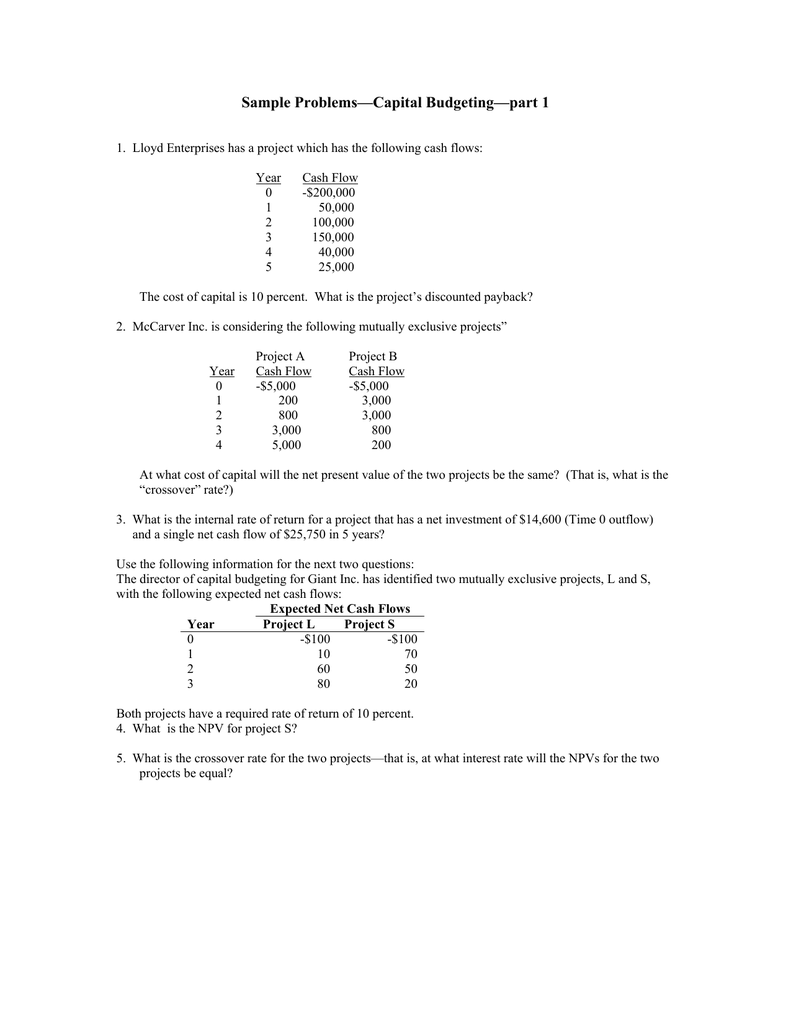

- When we have mutually exclusive projects, our decision rule needs to not only decide if a project is good or bad, but needs to be able to rank which project is the best.

- It allows companies to conduct a thorough and systematic assessment of various investment opportunities, aiding in informed decision-making.

- In this section, we will discuss some of the effective techniques for capital evaluation and how they can help us overcome the difficulties and uncertainties in capital budgeting.

- The capital budgeting process is also known as investment appraisal.

The Net Present Value measures the value added by investing in the project. Specifically, the NPV is equal to the present value of all cash flows less the initial investment. The Payback Period measures the amount of time it would take to earn back the initial investment in the project. Management then decides how long they are willing to wait to recover their investment (critical acceptance level — T) and compares the calculated payback period to the critical acceptance level.

Capital Budgeting: Meaning, Definitions, Nature, Importance, Components, Scope, Process, Methods, Problems

The primary capital budgeting techniques are the payback period method and the net present value method. It involves assessing the potential projects at hand and budgeting their projected cash flows. Once in place, the present value of these cash flows is ascertained and compared between each project.

#2 Net Present Value Method (NPV)

The discount rate used is self-selected as the required rate of return for the project. Once all discounted cash flows have been calculated, add all cash flows to arrive at the net present value. Evaluating capital investment projects is what the NPV method helps the companies with.

A downturn can reduce demand for your product or service, shrinking expected returns. Even rising inflation can erode profit margins by increasing costs. This uncertainty makes it hard to forecast if an investment will pay off.

Under this method, the entire company is considered as a single profit-generating system. Throughput is measured as the amount of material passing through that system. Also, payback analysis doesn’t typically include any cash flows near the end of the project’s life. These cash flows, except for the what is the last in first out lifo method initial outflow, are discounted back to the present date. The resulting number from the DCF analysis is the net present value (NPV). The cash flows are discounted since present value assumes that a particular amount of money today is worth more than the same amount in the future, due to inflation.

They can include delays in the project schedule and going over budget. This step quickly checks if a project fits the company’s goals. The company looks at early cost estimates and how much the project can earn. This quick assessment helps eliminate ideas that could be more practical. Therefore, project B has a shorter PP and is more preferable than project A. However, this does not imply that project B is more profitable or less risky than project A, as it ignores the npv and IRR calculations.

A number of investment opportunities may be available and may be attractive also. In such a case more than one opportunity may also be availed of. The mechanism for transitioning from a budgeted item to an approved project for execution is the Capital Expenditure Request (CER) or Authorization for Expenditure (AFE) Request. It’s these CapEx Requests that are typically subjected to delegation of authority approval prior to project setup and procurement activities officially commencing.

Net cash inflows for the Diamond LX and VIP Express are $126,000 ($73,000 + 53,000) and $148,680 ($76,980 + 71,700), respectively. Annual net cash inflow is the net cash inflow yielded by the investment. Annual net cash inflow is also used for the payback period method. It is important to note that both revenue and cost savings are considered cash inflows.

According to the rate of return on investment (ROI) method, Machine B is preferred due to the higher ROI rate. However, if we are going to focus on maximizing shareholder wealth, then we want to rank projects based on how they add value to the firm. The more value the project generates, the more wealth is generated for our shareholders. Jen Labs is considering the purchase of a new lab machine to test blood samples for specific viruses. The machine will require a $50,000 general maintenance service in year 3.