Content

Throughout the Us, they get a part-date jobs working for a chemical organization. The income gained while you are knowledge at the school are exempt away from societal shelter and you can Medicare taxation. The income earned in the chemical substances business is subject to public shelter and you can Medicare fees. To obtain the latest fee different, the fresh alien, or the alien’s agent, have to file the newest models and supply every piece of information necessary for the brand new Administrator otherwise his subcontract.

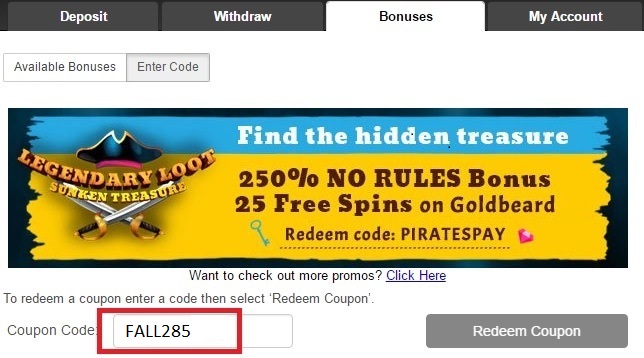

Just what Home loan Must i Get that have £70,100 Money? £70k Salary Financial – casino Quatro casino

Generally speaking, you have got need to know that a claim out of part cuatro reputation is actually unsound otherwise completely wrong should your experience with associated things or statements included in the withholding certification or any other documents try such that a reasonably prudent individual create question the newest allege are made. You would not provides reasoning to find out that a claim away from section cuatro reputation is unreliable otherwise wrong according to files obtained to possess AML homework aim before the time that’s 29 weeks pursuing the responsibility is made. If one makes an excellent withholdable percentage, you should withhold according to the assumption laws (chatted about later) knowing otherwise features cause to know that an excellent withholding certificate otherwise documentary evidence available with the new payee is unsound otherwise completely wrong to determine a great payee’s part 4 status. For individuals who rely on an agent to get files, you’re thought to discover, or provides need to know, the main points which can be within the experience with the broker for so it purpose. The newest WP need keep back below section three or four on the time it creates a delivery of a withholdable percentage otherwise an enthusiastic amount subject to part step three withholding to help you a primary overseas spouse based on the Function W-8 otherwise W-9 it receives from the people. For the option procedure for bringing withholding price pool guidance to own U.S. taxable people not utilized in a chapter 4 withholding price pond from You.S. payees, understand the Instructions to have Function W-8IMY.

Should i shell out my costs having a charge card? Is there an extra charges?

This can be interest paid on the any type of loans tool you to is actually secure by a mortgage or action away from believe to the genuine possessions located in the You, whether or not the new mortgagor (otherwise grantor) are an excellent You.S. citizen otherwise a good You.S. organization organization. Focus to the securities of a You.S. corporation paid back in order to a different company maybe not engaged in a trade otherwise organization in the us try subject to withholding even in case your interest is guaranteed by a different firm. A scholarship, fellowship, grant, targeted offer, otherwise a success prize acquired because of the a good nonresident alien to own issues held away from Us are managed as the international supply money.

- A good “reporting Design 1 FFI” try an enthusiastic FI, as well as a different part from a great You.S. standard bank, addressed while the a revealing lender under an unit step 1 IGA.

- Which signal applies even though you result in the commission so you can a keen NQI otherwise circulate-as a result of entity in the united states.

- TAS strives to safeguard taxpayer rights and ensure the brand new Internal revenue service is actually applying the fresh tax legislation inside the a reasonable and you will fair way.

- It’s in addition to well worth detailing there are financial solutions having no-deposit or as little as £5000, feel free to contact us if you were to think these could works to you personally.

- In the event the a citizen resides in the building for at least an excellent complete seasons, you to resident could be entitled to discover their unique put back and also the focus it made.

Should your person choosing the new grant otherwise casino Quatro casino fellowship grant isn’t a candidate to possess a diploma, and that is contained in the us inside “F,” “J,” “Yards,” otherwise “Q” nonimmigrant position, you should withhold income tax at the 14% for the complete number of the brand new offer that is of You.S. offer if the pursuing the requirements are came across. The brand new international person eligible to the brand new money must provide you with a type W-8BEN which includes the fresh TIN of one’s overseas person. The newest active international team portion of people bonus paid off from the a great residential corporation that’s a current 80/20 business is not at the mercy of withholding. A residential business is a current 80/20 organization if it satisfies the following.

What exactly is Barclays Loved ones Springboard Financial?

Company to own Worldwide Invention commonly at the mercy of 14% or 29% withholding. This is genuine even if the alien is actually subject to income income tax to your those people number. For individuals who discovered a form 972 of a foreign stockholder being qualified to the head dividend speed, you should spend and you may review of Mode 1042 and you can Function 1042-S people withholding tax you would has withheld if your bonus in reality had been repaid. Interest away from a series E, Series EE, Collection H, otherwise Series HH U.S. Deals Thread is not at the mercy of part step 3 withholding in case your nonresident alien personal gotten the connection when you are a citizen of one’s Ryukyu Isles or the Trust Territory of your Pacific Isles. Attention and you can unique thing write off one to qualifies as the portfolio attention is actually exempt from section step three withholding.

You can also lose a QI while the an excellent payee to your extent they takes on number one sections step 3 and you may cuatro withholding responsibility or number 1 Form 1099 reporting and you may content withholding obligations to possess a cost. You might see whether a great QI provides presumed responsibility in the Form W-8IMY provided by the brand new QI. To have part 4 aim, if one makes a great withholdable commission to an excellent U.S. people and you have real training the U.S. body’s getting the new commission while the an intermediary otherwise broker away from a different individual, you ought to eliminate the new overseas person as the payee.

The fulfillment are our very own concern along with your analysis out of your/the girl will determine their job score. Do it right initially, and contact your local Loan Market Financial Advisor – Sanjeev Jangra, to discuss your financial needs. If you buy in person (maybe not thanks to a representative), you need proof that you have paid off a fair field rate, such as an authorized valuation.

They kicked of within the April 2021, definition 5% deposit mortgages is actually right back on the table. It prompted the united kingdom Regulators in order to launch an alternative strategy inside the new spring season out of 2021, guaranteeing loan providers giving 5% put mortgages again. Inside level of the pandemic, banks were unwilling to take on you to risk, that is why it prevented offering highest LTV (or brief put) mortgage loans almost totally. That said, it’s have a tendency to a small trickier discover a little deposit mortgage than just if you had more cash saved. That’s while the shorter your deposit, the greater amount of of your property value the house or property your’ll must use.