Posts

For those who acquired railway no deposit bonus immortal romance pensions while you had been a nonresident alien, the fresh You.S. Railway Later years Panel (RRB) will send your Setting RRB-1042S, Report to own Nonresident Alien Readers out of Money by Railway Senior years Panel, and/or Setting RRB-1099-R, Annuities otherwise Retirement benefits by Railway Senior years Board. Should your nation away from judge home changed otherwise your own price away from tax changed inside taxation season, you can also found multiple mode. While the a twin-reputation taxpayer, you happen to be capable claim a reliant on your own income tax go back.

No deposit bonus immortal romance | Line 27 – Mental health Services Tax

You’re not engaged in a swap or company regarding the United states when the exchange for your own account within the stocks, ties, or products is your just You.S. company interest. It is applicable even if the change happens when you are present in the usa or perhaps is done by your own employee or your own representative or any other agent. If you aren’t yes whether the annuity is out of a qualified annuity package or certified trust, inquire the person who made the brand new percentage. This community comes with bona fide pupils, scholars, students, educators, professors, search personnel, experts, otherwise leadership within the a field of authoritative education or ability, or people of comparable breakdown. It also has the newest alien’s spouse and you can minor people once they come with the newest alien otherwise already been later to join the new alien. Some other neighborhood money is addressed while the available with the new appropriate people possessions regulations.

It’s best, if you features a quality list of casinos one someone prepared for you. Other data files is available in direct Paraguay. You will want to check out individuals offices to help you demand the newest Interpol record consider certificate, a certain criminal record certification to own foreign people provided because of the Police Informatics Department, and you will sign a couple bound declarations.

Because you can play for suprisingly low otherwise very large stakes, they’re most flexible headings also. At the same time, you could possibly provides max cash out membership associated with specific bonuses and offers. Keep in mind that these are only linked with what you victory of the fresh offered incentive, and when the individuals conditions try cleared, you are out from less than him or her immediately after your future put. That isn’t a permanent restrict on the membership by the people function.

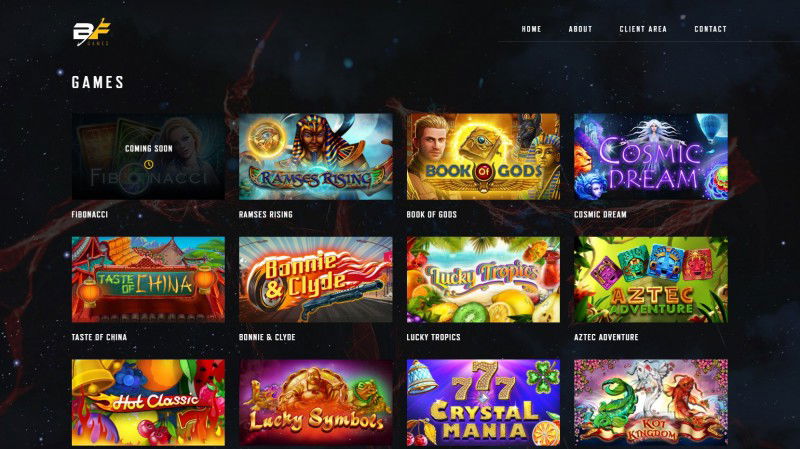

See Video game cost by the name and type

In a number of portion, it can be required that the fresh deposit money become kept in a no-attention rescuing otherwise escrow membership therefore it is going to getting offered at disperse-away time. Concurrently, they may be limited by using the funds apart from acknowledged expenditures. In a few says, possessions management enterprises can charge an animal put. They may also fees an alternative rate according to the animal kind of or reproduce. If you would like make use of the put to repair damage past normal wear and tear, render your own clients a summary of everything’re repairing, on the costs. The fresh contractors or assets government organization provide the list of problems.

If the a property owner fails to come back a safety deposit otherwise provide a keen itemized directory of write-offs in this 21 months, he’s prone to pay the citizen twice the original defense put matter. Usually, a security deposit is often the exact same amount since the monthly lease. So it percentage is during addition for the basic month’s book and almost every other fees to own programs and you will tools. Although not, landlords are able to use an application to gather book and defense places on line thanks to debit and you will credit purchases. You may use the newest Projected Fool around with Tax Search Dining table so you can imagine and report the employment tax due on the personal non-business stuff you ordered for under $step one,one hundred thousand for every. That one is readily available if you are permitted to report have fun with income tax on your own income tax return and you are clearly maybe not needed to make use of the Fool around with Tax Worksheet in order to calculate the utilization income tax owed to the all of your sales.

In case your fiduciary is actually submitting a revised Form 541, look at the package labeled Amended income tax go back. Finish the whole taxation come back, best the fresh outlines looking for the newest guidance, and you may recompute the fresh taxation responsibility. To your an affixed piece, explain the cause for the newest amendments and you can identify the fresh lines and you will amounts being altered to the revised taxation go back. Interest was energized for the fees not repaid by the owed day, even when the tax get back is actually filed because of the expanded due time. For more information, come across General Advice G, When to Document. The brand new submitting away from an income tax return for the bankruptcy proceeding home do maybe not relieve the private debtor of the private income tax debt.

On the February 1, 2024, Ivan relocated to the usa and you will stayed here for the remaining portion of the year. Ivan could possibly present a better connection to Russia to possess that time January six–10, 2024. You’re thought to features a deeper connection to a great international country compared to All of us for individuals who and/or Internal revenue service set that you have managed more critical connectivity on the overseas nation than just for the You. Inside deciding whether you’ve got maintained more significant contacts for the overseas country than just to the You, the details and points as sensed are, but are not limited to, the following. Carla are briefly in the usa inside the year as the a teacher for the a great “J” visa.

- Your own taxation responsibility ‘s the amount of the brand new income tax to the treaty earnings plus the taxation to your nontreaty income, but it can’t be over the newest income tax liability realized because the in case your income tax pact had not have been in effect.

- Such as, earnings regarding the selling away from catalog in the usa is actually You.S. resource earnings, if you bought it in the usa or perhaps in a good foreign country.

- By loitering right here which have Roost, you commit to all of our Terms of use, Legal Disclaimer, and you will Ads Disclosure.

- So you can get well 100% of the shelter dumps, make sure to get photographs of your own pursuing the portion (and you will include remarks to your video of any place).

Line eleven – Taxation

Produce “IRC Area 453A” to your dotted range alongside line 21. Are the income tax from the full on the internet 21b. Get into allowable attorney, accountant, and income tax go back preparer charges taken care of the brand new estate or the trust. Don’t document an amended tax return to inform the new fool around with taxation in past times said. If your fiduciary features change to your level of play with taxation before stated to your new return, contact the newest Ca Service away from Taxation and Payment Administration.

You could still generate benefits so you can a vintage IRA actually if you fail to subtract her or him. For those who made nondeductible efforts so you can a vintage IRA to have 2024, you must report them to your Mode 8606. For more information, find Range 13a regarding the Instructions for Form 1040-NR. You can deduct all the ordinary and you may required costs on the operation of one’s U.S. change or organization on the the total amount they connect with money effectively related to you to definitely trade or company.

DraftKings, FanDuel Promo Code: Assemble $three hundred inside Added bonus Wagers to have NBA, NHL, MLB Monday

Development arising from considered conversion process have to be considered to possess the new taxation season of the considered sales instead reference to other U.S. Losings out of considered transformation should be taken into account for the extent otherwise considering under U.S. Although not, point 1091 (regarding the disallowance from losings to your tidy conversion process away from stock and you may bonds) doesn’t apply. The net acquire that you must otherwise use in your revenue is smaller (although not less than no) because of the $866,100000 for individuals who expatriated or ended residence in the 2024.

The term deposit rate of interest evaluation is founded on things analysed because of the Money from banking companies included in the federal government’s Monetary States System. Automatically the new desk is arranged by higher rate of interest, up coming merchant term alphabetically. Consult the fresh vendor to possess full most recent account info, along with cost, charges, eligibility and you can small print – and you will find financial advice if required – to guarantee the product is most effective for you.

Probably by far the most tantalizing type wagering for the FanDuel Sportsbook software, parlay wagers enable it to be users to help you heap the odds heavens-high to own massive earnings. Parlays combine several playing lines and need each person foot in order to hit in buy on the wager admission so you can bucks. Growing monetary trend is actually determining it change, problematic antique financing procedures and you will demanding a more nuanced method from community benefits. An upswing away from Generation Z renters and you may a general change in occupant demographics is actually reshaping local rental market fictional character. She’s got nearly 15 years of expertise regarding the a home product sales community, along with a decade to the buyer side. In her own spare time, she features understanding science-fiction, investigating the new vineyards, and fostering Fantastic Retrievers.