Posts

Considering the reduce fee specifications and you may waived PMI there is usually a cost as paid back to make use of a health care provider mortgage. You to rates can come when it comes to a higher desire price (0.125% to help you 0.25% greater than a traditional mortgage) or in highest costs. Some doctors are finding excellent prices and you may fees which can be equivalent so you can a conventional mortgage.

Services

An automated 90-date extension of your time so you can file Form 8966 could be questioned. To request an automatic 90-go out expansion of time so you can file Mode 8966, document Setting 8809-We. Understand the Guidelines to have Form 8809-We to have where to document you to setting. You should request an extension once you are aware you to an expansion becomes necessary, but no afterwards versus deadline to own filing Function 8966. Less than certain difficulty conditions, the brand new Irs will get give an additional 90-go out expansion in order to file Function 8966.

Don’t blog post the social security number (SSN) and other private information regarding social media sites. Constantly protect your label when using people social networking webpages. The newest tax pact tables in past times in this guide have been up-to-date and you can relocated to Irs.gov/Individuals/International-Taxpayers/Tax-Treaty-Dining tables. A “reporting Model dos FFI” is actually an enthusiastic FFI discussed inside a model dos IGA who’s provided to conform to the requirements of a keen FFI agreement that have respect to a branch.

A different people will be allege the fresh direct bonus price from the filing the appropriate Form W-8. Such exemptions apply even although you don’t possess one records regarding the payee. It simple demands, it is not restricted in order to, compliance on the after the laws. A WP can also be lose as the head people those individuals secondary lovers of one’s WP where it can be applied joint membership medication or the newest agency solution (explained after). A great WP need to if not topic a questionnaire 1042-S to every partner on the extent it’s expected to take action under the WP contract. You can even matter an individual Function 1042-S for all payments you create so you can a good WP aside from money in which the brand new organization will not act as a good WP.

- Department of the Treasury and condition financial bodies to add their customers which have a secure, safe fee solution.

- For that reason, amounts perhaps not at the mercy of chapter 3 withholding which commonly withholdable money which can be paid back to an excellent U.S. part aren’t at the mercy of Setting 1099 reporting or copy withholding.

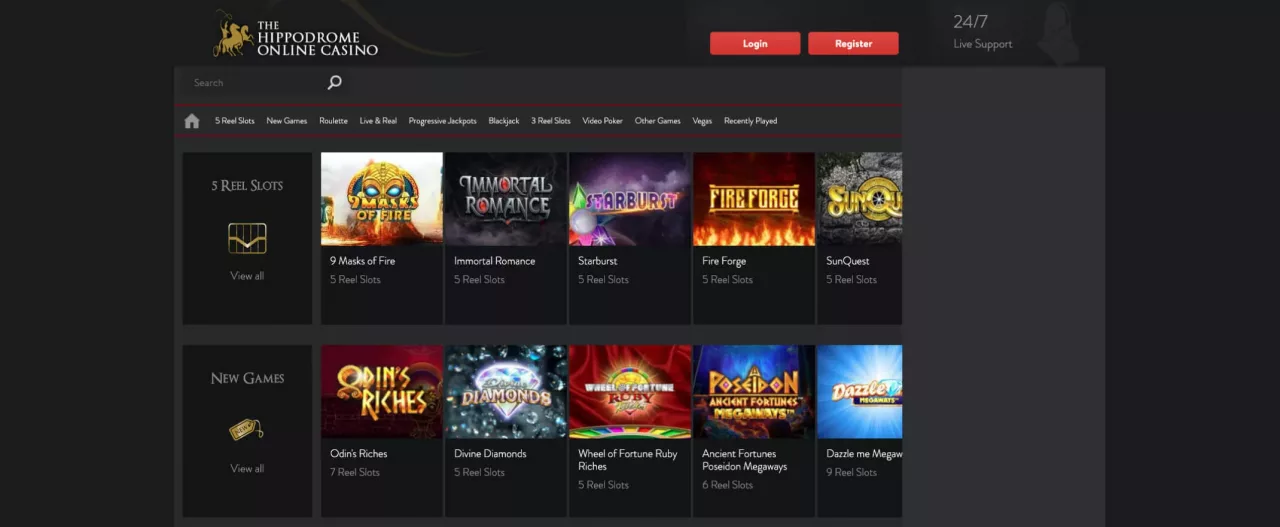

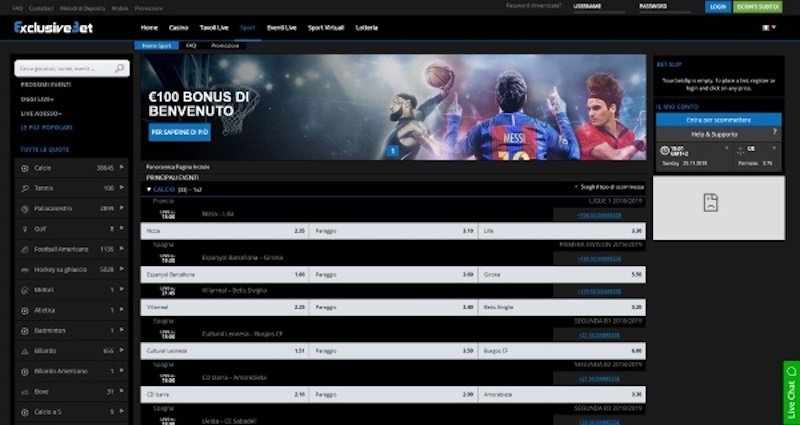

- Which list includes just websites that offer the most effective sort of online banking, credit/debit notes, e-purses, prepaid service coupons, and other procedures, that should be quick, easier, and you may protected by the brand new SSL security and you may firewalls.

Western Tower Corporation (AMT)

The choice relies on your financial requirements, chance endurance, and you will https://vogueplay.com/in/sunbingo-casino-review/ management preferences. Home generally now offers far more secure productivity, potential taxation pros, and you will local rental income but demands productive government and you may large initial investment. Carries give highest possible productivity, better exchangeability, and lower maintenance requirements but i have more rates volatility. Realty Income Corp is actually a good REIT which was based inside the 1969 to the number one purpose of getting traders having month-to-month earnings you to definitely do improve over time. Realty Earnings’s returns is paid back from cash produced thanks to hired home, and since going public within the 1994, the company has exploded its collection to more eleven,100 functions in every 50 says (in addition to Puerto Rico, the brand new You.K. and you can The country of spain).

Doctor mortgages as well as essentially just look at the full necessary student mortgage percentage, not the quantity due, and they’ll fundamentally undertake a finalized employment deal as the proof of income, instead of demanding income tax stubs. Separate contractors tend to nonetheless you desire two years of taxation statements to confirm money. System is open to the being qualified medical professionals regardless of years in the practice, versatile underwriting for the figuratively speaking, downpayment and reserves is generally talented, excellent buyer service, and you can chosen financing repair. I specialize in doctor financing and possess more than 2 decades away from knowledge of mortgage loan originations.

Equity Home-based

To get to the bottom of which, we should instead go through the relevant gaming regulations. First, gaming in the usa try controlled to your a state, government, and you can, needless to say, regional peak. Thinking about these amounts of regulations, really the only practical conjecture you might obtain is that things are destined to score messy. PartyPoker introduced in the 2001, and has centered a good reputation in that go out. It properly provides one another scholar and much more experienced participants, and you will strong, credible protection have aided they become one of the most top casino poker web sites. Other unique part of PartyPoker ‘s the normal web based poker Series one to it operates, giving huge prizepools and you can enjoyable tournaments drawing a huge number of participants.

For those who have a current agent or economic coach, install a speak to talk over the principles out of genuine property paying and how it will fit into your financial plan. You can also consider contacting regional real estate agents to see if they should opinion the basics and you may highly recommend worthwhile info. Hooking up having regional investment fans will likely be a good treatment for engage with the true home community and increase your degree.

If you remain getting the fresh sales continues to the other investment property, you could delay funding development taxation forever. The good news is, there are ways to lose him or her on your family product sales, or avoid them completely. The new Internal revenue service offers a few conditions to stop funding progress fees whenever offering your residence. Generally, financing development income tax is the taxation owed for the money (aka, the capital obtain) you make when you promote a good investment or asset, together with your household. It is determined by deducting the fresh advantage’s new rates otherwise price (the newest “taxation foundation”), as well as one expenses incurred, in the final sales price.

Tax Sees to have Indians having Dubai Property: Key Information about the brand new FAIU, Black Money Act, and you will Overseas Taxation Effects

When you’re needing an agent the new Light Finish Buyer couples which have CurbsideRealEstate.com, a totally free a house concierge services to have physicians, because of the medical professionals. Just after battling because of his first family buy, Dr. Peter Kim centered Curbside A home to deal with physician-particular items discovered in the real estate techniques. In addition to taking development and suggestions, CurbsideRealEstate.com will be your physician-added “curbside request” to own physician mortgages, expert realtors, relocation, and all things in between. If or not your’lso are securing your first medical practitioner mortgage, simply delivery your residence lookup, or you aren’t yes the direction to go, CurbsideRealEstate.com makes it possible to navigate your house to shop for procedure with confidence and effortlessly, saving you work-time and cash. From the NEO Home loans, we are experts in flipping the fresh hopeless for the easy for medical professionals and you will most other medical professionals looking to a mortgage.

Rental Income and money Flow Potential

For many who don’t want to tolerate the brand new horror out of managing an excellent rental property otherwise can be’t make the newest advance payment, owning a home trusts (REITs) are a great way first off investing a home. If the a residential otherwise international relationship having one foreign partners disposes of an excellent USRPI during the a gain, the newest acquire is actually addressed since the ECI that is generally susceptible to the rules explained earlier under Union Withholding to the ECTI. A foreign relationship one dumps an excellent USRPI get borrowing the fresh taxes withheld because of the transferee up against the tax liability determined less than the partnership withholding to your ECTI laws and regulations. That it code can be applied when the assets disposed of is actually acquired because of the the brand new transferee for usage because of the transferee as the a property. In case your number understood to the such as temper doesn’t exceed $three hundred,100000, zero withholding is required. Otherwise, the fresh transferee need basically withhold 10% of your own number know by a different person.

Invest in Turnkey Characteristics

A different partnership you may own the brand new USRP, such that a desire for the new overseas union may be addressed because the a keen intangible and not felt located in the united states. There’s certain chance that Internal revenue service might take an excellent lookthrough means based on the aggregate method to treating sales and you can exchanges from partnership hobbies in the Secs. 864(c)(8) and you can 1446(f) and check for the situs of your hidden relationship assets to choose the location of the USRP.

Commercial home benefits from comparably expanded lease agreements which have tenants than simply home-based a home. This provides the economic home owner a great deal of cash flow balance. Zero. The fresh Maine a home withholding matter is actually merely a quote of the taxation owed for the acquire on the sale of one’s Maine property. An excellent Maine income tax go back have to be submitted to search for the real taxation due to the obtain and you may even though a reimburse stems from your. In some instances, an extra amount is generally due to the Maine income tax return recorded.