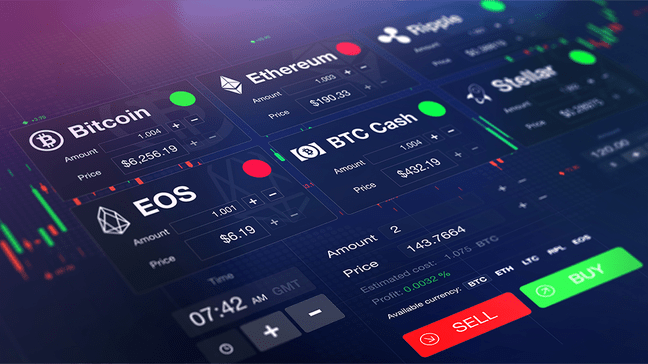

Crypto Trading Strategy Bot: A Comprehensive Guide

In recent years, the popularity of cryptocurrency trading has soared, leading to an increase in the demand for automation tools. One such tool that has gained traction is the Crypto Trading Strategy Bot. These bots can help traders navigate the volatile waters of cryptocurrency markets by executing trades based on pre-defined strategies, allowing for a more disciplined approach to trading. This article delves into the benefits of utilizing a trading bot, various strategies one can implement, and best practices to ensure successful trading experiences. For further insights, you can also check this link: Crypto Trading Strategy Bot https://www.freedomsphoenix.com/Forum/013555-2007-01-01-keep-those-kevlar-jammies-handy.htm.

What is a Crypto Trading Strategy Bot?

A Crypto Trading Strategy Bot is a software designed to automate trading activities based on pre-set conditions or strategies. These bots can analyze market data, execute trades, and even manage portfolios without human intervention. They can operate 24/7, making them useful in the fast-paced cryptocurrency market where prices can change rapidly.

The primary function of these bots is to remove emotional and psychological factors from trading decisions. By following a well-defined strategy, traders can minimize the impact of greed or fear on their trades, leading to more consistent results.

Benefits of Using a Trading Bot

There are several advantages to using a Crypto Trading Strategy Bot, which include:

- Emotion-free Trading: Bots operate based on logic, allowing for a more rational approach to trading.

- 24/7 Operation: Cryptocurrency markets never sleep, and neither do trading bots. They can monitor the market at all times.

- Backtesting: Traders can test their strategies against historical data, refining them before deploying in real-time.

- Efficiency: Bots can execute trades faster than any human, reducing the chances of missing out on favorable market conditions.

- Customization: Many bots allow users to configure settings to fit their trading needs and risk tolerance.

Types of Trading Strategies for Bots

Various trading strategies can be implemented using a Crypto Trading Strategy Bot, each suited for different market conditions and trader preferences. Here are a few popular strategies:

1. Arbitrage

This strategy involves buying a cryptocurrency on one exchange at a lower price and simultaneously selling it on another exchange at a higher price. Trading bots can quickly detect price discrepancies across exchanges, making arbitrage trading an attractive option for profit.

2. Market Making

Market making involves placing buy and sell orders at specified prices to profit from the spread between the two. Bots can manage these orders to ensure that they remain competitive and can capture any fluctuations in prices.

3. Trend Following

A trend-following strategy aims to capitalize on upward or downward price movements in the market. Bots can be programmed to identify trends based on various indicators, such as moving averages or momentum oscillators, and execute trades accordingly.

4. Mean Reversion

This strategy is based on the concept that, over time, prices will revert to their mean or average levels. Bots can identify overbought or oversold conditions and execute trades to capitalize on corrections.

How to Set Up a Crypto Trading Strategy Bot

Setting up a Crypto Trading Strategy Bot involves several steps. Here’s a simplified process to help you get started:

1. Choose Your Bot

There are various trading bots available, each with its own features and capabilities. Research and choose a bot that fits your trading style and strategies.

2. Define Your Trading Strategy

Determine your trading strategy based on research and analysis. Understand your risk tolerance, preferred cryptocurrency pairs, and specific goals to shape your bot’s parameters.

3. Backtest Your Strategy

Most trading bots allow backtesting against historical data. This feature is crucial for understanding how your strategy would have performed and for making necessary adjustments.

4. Connect to Exchanges

Configure your bot by connecting it to your trading exchange accounts using APIs. Ensure you understand how to manage API keys securely to protect your assets.

5. Monitor and Adjust

After launching your bot, continuously monitor its performance. Be ready to make adjustments based on market conditions and the bot’s trading outcomes to optimize performance.

Common Risks and Challenges

While utilizing a Crypto Trading Strategy Bot can be advantageous, it’s essential to acknowledge the risks involved, such as market volatility, technical failures, and the potential for significant losses. Traders must stay informed about market trends, remain flexible, and continuously evaluate their strategies.

Conclusion

In conclusion, a Crypto Trading Strategy Bot can be a powerful tool for anyone looking to maximize their gains in the cryptocurrency market. By removing emotions from trading, operating around the clock, and enabling the implementation of various strategies, these bots offer a structured approach to trading. However, it’s crucial to understand the strategies you deploy, manage risks appropriately, and continuously educate yourself to navigate the ever-changing landscape of cryptocurrencies successfully.