The rewards make saving fun, and the funding alternatives make saving even more rewarding. By investing your cash in Fello, you possibly can grow your money and keep it safe from the results of inflation. With prudent investment choices and persistence, you’ll have the ability to work in the path of attaining your monetary dreams with these rewarding belongings. AI-driven trading algorithms can process vast quantities of knowledge in real-time, making lightning-fast decisions based on market developments, historic knowledge, and other elements. This leads to more correct predictions and permits merchants to capitalize on market alternatives extra https://www.xcritical.in/ effectively. First and foremost, AI algorithms can course of and analyze large quantities of knowledge a lot faster than human traders.

How Ai Is Transforming Crypto Choices Buying And Selling: Key Insights From Saketh Ramakrishna

By analyzing huge quantities of data and identifying patterns that will not be Prime Brokerage obvious to human merchants, AI algorithms can help merchants make more informed investment decisions. AI, or synthetic intelligence, refers to the software of machine learning, natural language processing, and different computational techniques to investigate market knowledge and make trading selections. In the context of stock trading, AI algorithms can course of and interpret vast quantities of structured and unstructured information, together with monetary statements, information articles, and social media sentiment. In today’s fast-paced stock market, staying on prime of market sentiment is crucial for making informed buying and selling selections.

Don’t Miss Out On The Ai Revolution! Companion With Us For Game-changing Synthetic Intelligence Growth Companies

The huge availability of varied investment alternatives in the Indian market creates advanced situations for traders while making investment selections. Artificial intelligence uses its know-how Machine learning to read previous monetary information, analyse, interpret, and assist buyers in arriving at final decision-making. The world of monetary administration is changing rapidly, with every thing from sophisticated investing platforms to automated budgeting software ai brokerage.

How Ai Is Transforming The Financial Trade, From Predicting Market Developments To Automated Buying And Selling Strategies

- AI buying and selling systems for stocks incorporate risk administration methods that restrict the risk of potential losses.

- With the help of Artificial Intelligence loan approval process has been made simplified and sooner.

- AI algorithms can process vast amounts of data and determine patterns that people would possibly miss, however they lack the contextual understanding and instinct that skilled merchants bring to the table.

- The widespread adoption of AI by banks and financial establishments has already led to important improvements in automation, credit decision-making, buying and selling, danger management, fraud prevention, and customized banking.

There may be a compromise in data privateness, which may occur due to leakage of knowledge like proprietary info and so on. With so many challenges, it is in the best interest of the customers of this expertise to consider all the professionals and cons before leaping head-on into it. The details mentioned in the respective product/ service doc shall prevail in case of any inconsistency with respect to the information referring to BFL products and services on this page. Collaboration between regulatory our bodies, know-how builders, and market participants is important to create a balanced method that promotes innovation whereas safeguarding market integrity. With AI and ML, specialists additionally anticipate lowered danger of human error and lesser emotional biases like worry or greed that always are inclined to cloud judgment during market fluctuations. The world AI buying and selling market was valued at $18.2 billion in 2023 and is predicted to nearly triple in size by 2033.

Integrating Ai Into Your Existing Buying And Selling Technique

Short-term merchants aim to earn fast cash by profiting from the market’s fluctuations. Day traders operate on an intraday time horizon, buying and selling a quantity of instances in a day or a few days. Swing traders have more of a long-term view, seeking developments and a pattern for months or even weeks. Long-term buying and selling involves purchasing and holding a firm’s shares for prolonged durations, sometimes a few years and even decades.

When the predefined rules are met, orders are immediately placed at a velocity and frequency that is unimaginable for human traders. Algorithm trading is probably the most direct and extremely used technique in funding management. Investors, especially traders use AI algorithms to evaluate huge datasets that trade at high speeds, making buying and selling on current market patterns and trends.

AI and machine studying leverage know-how to identify signals and capture underlying relationships between giant data units to make decisions concerning clever asset allocation and stock selection. In this article, we explore how AI has reworked our method to investment methods. As the world of finance is continually changing, adopting AI isn’t just an choice but an essential requirement for buyers who wish to improve their earnings whereas minimizing risks. If you might be also trying to construct a extra substantial funding portfolio that is risk-adjusted, contemplate utilizing AI models and tools to find out the value of shares with larger precision. AI can perform thorough backtesting and simulations of buying and selling strategies primarily based on historic data.

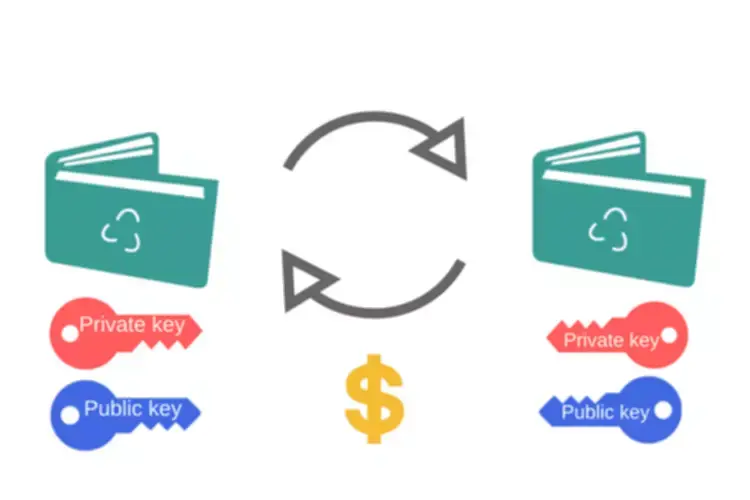

The integration of AI with different rising applied sciences, similar to blockchain and quantum computing, may further revolutionize buying and selling methods and open up new potentialities for investors. By staying at the forefront of those developments, merchants can continue to refine their AI-driven portfolio optimization methods and preserve a competitive edge within the fast-paced world of inventory market trading. While predictive analytics has undoubtedly enhanced traders’ capability to identify promising stocks, it’s essential to recognize that AI isn’t a silver bullet. Predictive fashions are solely as good as the info they’re trained on and the assumptions they make. As such, merchants should exercise warning and mix AI-generated insights with elementary evaluation and human judgment.

Stock buying and selling is usually categorized in accordance with the popular holding time, also referred to as a time horizon. Investment within the securities entails dangers, investor ought to consult his own advisors/consultant to find out the merits and dangers of funding. If the information is biased, the AI may end up making predictions which might be off and will mislead investors. Ensuring that AI fashions are educated on correct and unbiased datasets is important to stop biased decision-making. The Sensex and Nifty50, two of India’s main stock market indices have been on a constant uptrend in the earlier few years.

The primary advantages of AI-powered information analytics are figuring out hidden patterns and multilevel insights in market knowledge that may be imperceptible to human analysis. This enables brokers to equip themselves with effective data, determine high chance alternatives, and mitigate risks more effectively. By analyzing vast quantities of historic knowledge, AI algorithms can quickly detect patterns that human analysts would possibly ignore and use the data to formulate exact forecasts of future inventory costs. This enables merchants to make more informed funding choices with higher precision and understanding. AI-powered predictive analytics have the potential to dramatically improve buying and selling methods, reduce risk, and improve overall revenue. As AI continues to advance, its integration into the financial business will only grow stronger.

AI-driven predictive fashions have revolutionized the method in which traders method stock selection. These sophisticated algorithms analyze vast datasets, including firm financials, trade tendencies, and macroeconomic indicators, to identify shares with excessive progress potential or undervalued belongings. One of the key benefits of AI in inventory market analysis is its capacity to uncover advanced relationships between numerous market elements that will not be apparent to human analysts. By analyzing vast amounts of historic data, including economic indicators, firm fundamentals, and international events, AI algorithms can determine hidden patterns and correlations that can inform buying and selling methods.

If you rely considerably on automated techniques like AI and ML, you’ll have the ability to lose control over buying and selling decisions. Another concern is the shortage of transparency and interpretability of some AI algorithms, particularly deep studying models. These “black box” models could make it troublesome for traders to understand how the algorithm arrived at a particular decision, which may be problematic from a regulatory and accountability perspective. They could be vulnerable to biases, errors, and unexpected market events which will require human intervention to appropriate.

Imagine a time when you needed to name up your broker to simply place an fairness trading order on inventory exchanges. Who would have thought that the fairness trading landscape would change so rapidly and drastically? Today, you presumably can place fairness orders with your fingertips, utilizing your smartphone or simply a computer. Similarly, you’ll have the ability to read up on information, get to know more about companies and research shares on-line. With the digitisation of monetary market transactions, the method of purchasing for and promoting securities is getting smoother.